By Severin Fischer for Center for Security Studies (CSS)

The massive expansion of shale oil extraction in the US marked the beginning of a global glut in the petroleum markets. According to Severin Fischer, this is just one of many factors raising the pressure on OPEC and other oil producers. So, how has OPEC responded to the growing supply of relatively cheap oil? In this article, Fischer responds and identifies two possible future trajectories for the global oil market.

The massive expansion of shale oil extraction in the US marked the beginning of a global glut in the petroleum markets. According to Severin Fischer, this is just one of many factors raising the pressure on OPEC and other oil producers. So, how has OPEC responded to the growing supply of relatively cheap oil? In this article, Fischer responds and identifies two possible future trajectories for the global oil market.

The massive expansion of shale oil extraction in the US marked the beginning of a global glut in the petroleum markets. This is just one of many factors raising the pressure on OPEC and other producers. Two possible development trends are emerging.

Venezuela’s current political and economic crisis encapsulates the hard times that some major oil-producing countries are experiencing these days. The high revenues of the years 2008 through 2014, when prices stood at well over USD 100 per barrel (USD p.b.), have fostered mismanagement and corruption in many petro-economies. After the collapse of prices in late 2014, societal expectations of state services could often no longer be fulfilled. Ever since, governments have been coming under increasing pressure.

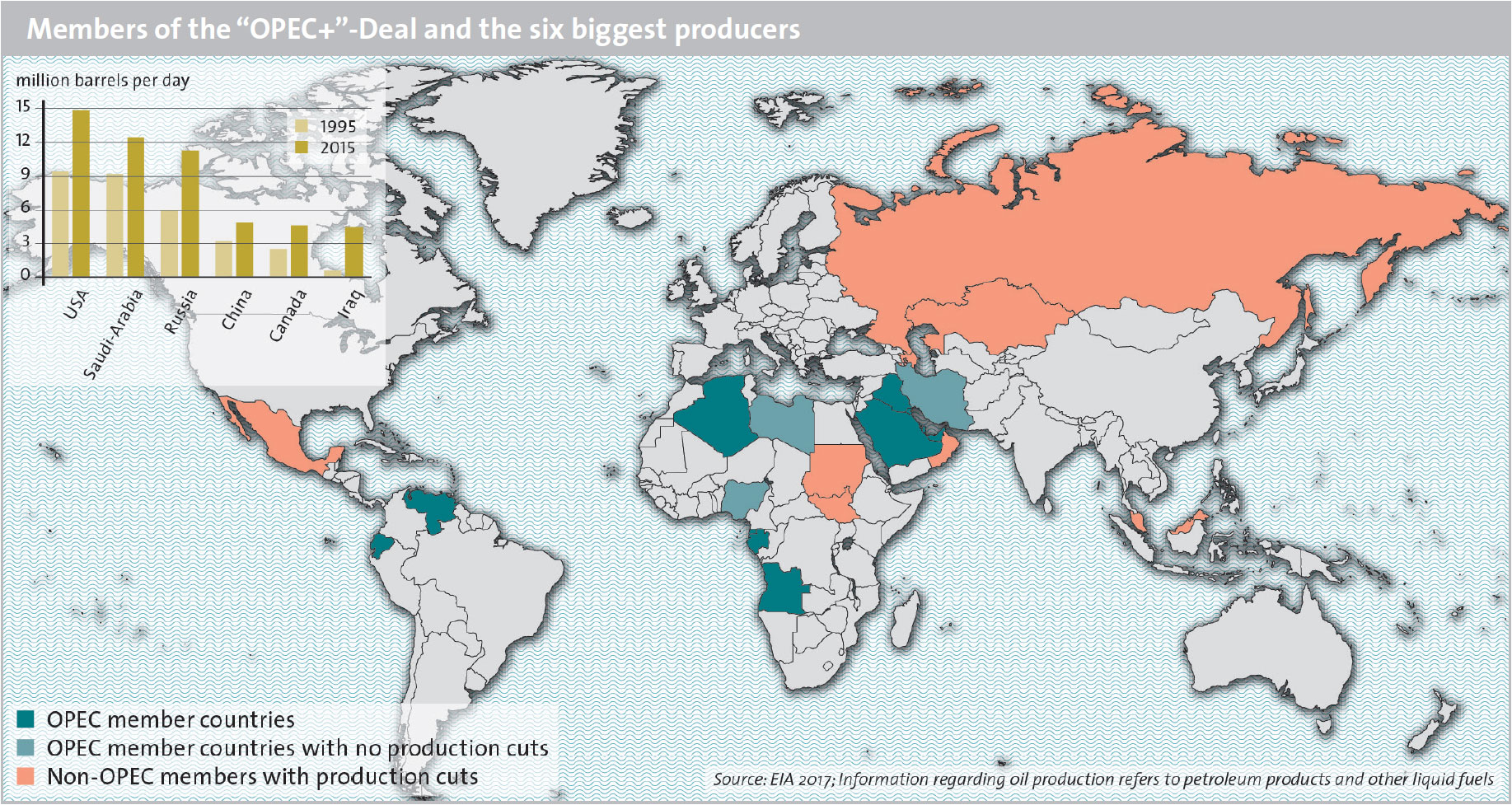

Against this background, the Organization of Petroleum Exporting Countries (OPEC), together with 11 other oil producers, decided in November 2016 to throttle extraction rates to achieve a price increase. Despite widespread expectations among many experts to the contrary, the group has so far largely succeeded in meeting its commitments and demonstrating the ability to act. However, it is still too soon to determine whether this will ease market tensions in the long run.

The global oil market is characterised by an oversupply since the beginning of 2015. Duvignau/Reuters

Changes in the Oil Market

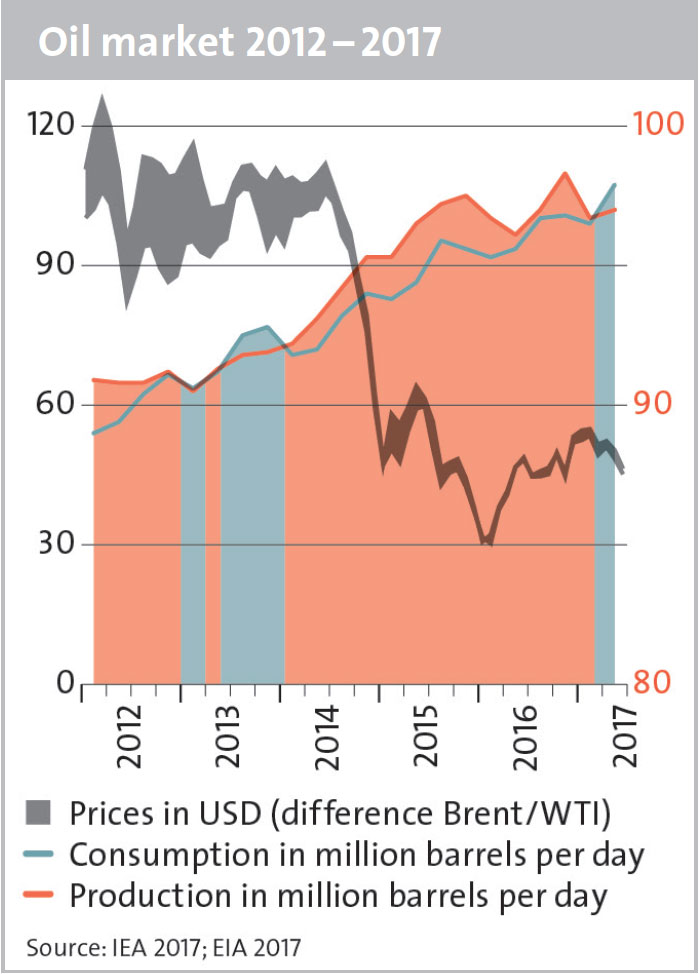

Developments in the global oil market over the past decades can be broken down into three phases. Starting from a phase of relative stability pre-2004, when prices usually peaked at below USD 30 p.b., 2005 saw the start of a phase of high price volatility, which was seen as caused by the growth of emerging economies and the resulting shortage of supply. A high-water mark of nearly USD 150 p.b. was reached in early 2008, followed by a price collapse in the wake of the global economic crisis. A third phase can now be discerned since the beginning of 2015, with price levels remaining largely below USD 50 p.b., a clear oversupply on the oil market, and the accumulation of massive stocks. The main drivers in the current situation are the considerable expansion of shale oil production in the US and a stronger-than-expected decline in demand pressure, caused by a reduction of energy intensity in the manufacturing sectors of emerging economies.

Without question, the main factor of change is to be found in the US. After seeing a decline in production from about 2.5 billion barrels annually in the 1980s to 1.8 billion barrels around the year 2005, the country had already begun strategic preparations for a noticeable increase of import dependency. However, beginning in 2008, the development of new extraction techniques and an advantageous regulatory framework favored a strong increase in oil production from unconventional sources. By 2015, at 3.5 billion barrels annually, the US was producing more oil than ever before. At the end of that year, it lifted the export ban on crude oil, which had been in force since the first oil crisis of 1973, reflecting a changed perspective on oil markets. The new administration of US President Donald Trump even went one step further and has recently labeled its new approach “energy dominance”.

The US shale oil industry is characterized not only by rapid growth, but also by sensitivity to short-term price fluctuations and the flexible nature of the many small independent companies operating thousands of wellheads. For instance, the abrupt collapse of prices in 2014 brought a swift consolidation of the market, together with a series of bankruptcies. However, production picked up again nearly as quickly in 2016; this time, the cost per drill site had been reduced by one third, and the productivity of each individual wellhead had been doubled. Thus, since 2014, the US shale oil industry has established itself as the third important collective actor, next to the politically controlled state companies of OPEC member countries and the major Western oil and gas companies. However, the shale oil industry operates largely independently of the political sphere, responding primarily to price signals.

While structural changes have strongly influenced the supply side in the past decade, demand appeared rather stable. Although oil consumption has most recently dropped below predictions, a decline of global demand on the scale required for climate protection is not yet apparent. Nevertheless, demand in 2015 and 2016 plainly lagged behind the rapid increase of supply, suggesting, despite the absence of hard data, that global oil stocks are at an all-time high. One indication of temporary oversupply is the fact that political crises in and between oil-producing countries, such as the Saudi embargo against Qatar or the independence referendum in the oil-rich Kurdish region of Iraq and the subsequent conflict over the oil wells near Kirkuk, had little long-term effect on prices.

OPEC in Transition

Since the foundation of OPEC in 1960 and the first oil crisis of 1973–4, the cartel of oil producers has been the point of reference when it comes to geopolitical developments in the oil market. From its foundation, the organization has had the stated aim of applying political pressure to control production quotas and prices. The first successful example of such pressure was the boycott against Western supporters of Israel in the 1973 Yom Kippur War.

However, when considering OPEC’s role as a mighty oil cartel, observers often underestimate the heterogeneity of its membership. A huge imbalance of power and influence between the rich states of the Persian Gulf, which have high output and benefit from low extraction costs, and the poor oil-producing states of South America and Africa, where costs are high and production is low, has become more and more obvious in recent years. In addition, OPEC is riven by severe clashes of interest and political conflicts, which are most palpably manifested in the decades-old hostility between two major producers, Iran and Saudi Arabia. This is why experts have argued for years over whether OPEC, given its limited share of global supply and its internal conflicts, should even be considered a “cartel” anymore. What seems certain, however, is that Saudi Arabia alone, as the biggest OPEC producer and accounting for one third of the organization’s output, is the only actor able to affect the global oil market individually by expanding or throttling its flexible production volume.

Between the 1970s and the mid-2000s, the global oil supply system gradually adopted a governance structure that was shaped on the producer side by OPEC, its main member Saudi Arabia, and its flexible output. On the consumer side, the International Energy Agency (IEA) was created as the institutionalized representation of the Western consumer states. However, in practical terms, the US with its strategic oil reserve, with its military presence in the Middle East, and acting as the guarantor of maritime trade routes ensured that the overall system operated smoothly. European and Asian industrialized nations benefited from the mutual arrangements between the energy heavyweight and the military superpower without being required to contribute significantly themselves.

The huge growth in Asia’s emerging economies in particular and the shale oil revolution in the US have eroded these governance structures over the past decade: The IEA and the US no longer represent the spectrum of consumers, nor does OPEC control the lion’s share of production. The US-led invasion of Iraq in 2003 seems to have rung the death-knell for US efforts to safeguard energy interests by military means in the Middle East. With the rapid growth of production in the US, securing access to regional oil sources will likely become less important to Washington, at least in the medium term.

From the perspective of the consumer states, the challenges posed by the development of prices and market fluctuations are mainly economic in nature; but for many governments in oil-producing states, these are questions of political survival. Following the price collapse of late 2014, many OPEC states vocally and urgently demanded measures to stabilize oil prices on a higher level. A strategic decision by the Saudi royal family reflects the extent to which interests within OPEC are currently diverging: Rather than responding to increased US shale oil extraction by cutting its own production rates and thus stabilizing prices, Saudi Arabia maintained its high production rates in order to undercut its new competitor across the Atlantic with low prices and thus assert its own predominance on the oil market.

However, the Saudi refusal to throttle production was not only aimed at the new competitors in the US: After the recent lifting of US sanctions, it wanted to ensure that Iran would be prevented from making urgently needed investments in its obsolete oil industry, and would thus be economically contained.

The OPEC+ Deal

Even though this strategy delivered short-term successes for the House of Saud and a number of shale oil companies went bankrupt, it became clear during the course of 2016 that the US competitors had swiftly adapted to the new situation with impressive gains in efficiency and productivity. A change of strategy on the part of OPEC thus became more and more apparent as 2016 went on. After flooding the market with cheap oil in the first place, now a limitation of production was signaled. The risk of regime collaps was to big and the effect of the market glut was too limited on the new overseas competitors. Within OPEC, the challenge was now to convince the economically struggling member states to agree to production cuts in the hope of increasing revenue by pushing up prices globally. OPEC members Iraq, Nigeria, and Libya, devastated by military conflicts, declared themselves unable to support production cuts given their current levels of extraction. The Iranian government, too, refused to consider any throttling of output below the production threshold that had prevailed at the beginning of the US sanctions regime.

It was ultimately Russian President Vladimir Putin who brokered the deal on OPEC production cutbacks that was achieved in November 2016. Russia, which was also hard hit by the sustained decline in prices, not only mediated between the Iranian and Saudi governments, but also offered to curtail its own production, which would add Russia’s weight as the world’s third-largest oil producer to the suppliers’ camp. Another 11 non-OPEC oil-producing countries joined the agreement.

The agreement on a production cut, known as “OPEC+”, centers on a decision to trim output by 1.8 million barrels per day compared to production levels as of November 2016. Just as with earlier production cuts, there are no effective mechanisms in place for verification or sanctions. The agreement is based on mutual trust in the other states’ implementation of measures. Libya and Nigeria are exempted from the cutbacks. The Iranian government only agreed to limit the increase of its production. Contrary to the expectations of many observers, the deal has so far proven quite robust. This is mainly due to the agreed reference date, which was shrewdly fixed at a time when output levels were high in all countries. Moreover, the record varies considerably among the individual oil-producing countries when it comes to implementation. While the non-OPEC producers cut back production even further than agreed, most OPEC states failed to adhere fully to their commitments. Saudi Arabia did comply with the deal and even compensated for the shortcomings of other OPEC members.

Essentially, the OPEC+ deal was and still is an attempt to signal the organization’s capacity to act. This may be judged a success to the extent that the oil price has been stabilized above the USD 50 p.b. mark and that supply and demand have converged in the market. Against this background, it is very likely that the agreement will be extended at the OPEC ministerial meeting of November 2017 beyond its current expiry date in March 2018.

Politically, recent developments have left Russia the clear winner. With its own commitment to support the strategy of production cutbacks, and by mediating between the Iranian and Saudi governments, the country has gained kudos as an actor in the Middle East. The first visit by a Saudi king to Moscow in October 2017, the rapprochement with Turkey, and the stabilization of the situation in Syria due to Russia’s intervention on behalf of al-Assad have made Russia a relevant partner in dialog for all actors in the region. Moreover, should Russia and other non-OPEC producers continue to go along with cutbacks in production, this would send a positive signal of stable and consistent Russian engagement in the oil market.

For OPEC itself, the past two years are likely to have served as a wake-up call regarding its own ability to act. The unilateral dependency on Saudi-Arabia’s actions and the necessity to seek partners outside of the organization need to be acknowledged and dealt with as part of a learning process. Another unpleasant truth that needs to be faced by many oil-rich states is that their own influence on the oil price is limited and that without massive structural overhauls of their own economic systems, it will be difficult to develop a strategy for the future, let alone ensure the survival of their own regimes.

Countervailing Future Trends

It has always been difficult to make serious predictions about long-term developments in the oil market and their political effects. Nevertheless, we may identify certain trends, each of which incorporates a number of influencing factors and thus suggests a possible trajectory. Two main tendencies can currently be identified for the oil market:

Peak Demand: While the debate over “peak oil” – with warnings of an imminent global production plateau, a continuous decline of global oil production, and predictable conflicts over limited resources – has shaped the energy security concerns of many governments in the past, the notion of a looming end of oil can be discounted for the time being in light of the boom in US shale oil. At the same time, discussions over energy policy more frequently refer to the concept of “peak demand”, according to which demand for oil will reach a plateau and then decline within the foreseeable future. Reasons given include the successes of electromobility and the substitution of petroleum products in the transportation sector. In addition to the potential technological success of battery-operated vehicles, it is mainly the growing environmental problems in cities and the limitations in consumption imposed by climate policy following the Paris Agreement that might trigger “peak demand” in the 2020s. Even oil market heavyweights like Saudi Arabia are taking the trend towards a transformation of energy supply seriously, as evidenced by plans to restructure the state enterprise Saudi Aramco and to diversify the country’s economy under the “Vision 2030” plan. If petroleum should indeed decline in importance worldwide, this would initially lead to sustained low price levels and subsequently cause huge problems for petro-states with lopsided economic structures.

The “Investment Gap”: A second trend for the coming years suggests a shortage of core long-term investment in the surveying and exploration of new sources. Under the current low price levels, multinational corporations in particular are abandoning plans for costly deep-sea or Arctic projects and instead investing in other areas beyond the petroleum sector. At least in the short to medium term, low oil prices suggest global demand will increase. Also, while cars in the transport sector are the biggest single consumer of oil, they still only account for about 30 per cent of demand and are thus by no means the sole factor in determining demand. Therefore, if prices remain low in the medium term, if no investments are made, and if demand continues to rise, we may expect sharply increasing prices and high volatility. Moreover, due to cost structures, oil production is likely to be concentrated geographically in the OPEC states and Russia on the one side and the North American continent on the other, having in mind that the shale oil boom could also come to an end one day. Under this scenario, detrimental effects on the global economy are likely.

These two trends may appear to be contradictory at first glance. Nevertheless, when considering historic developments in the oil markets and transformations of energy policy in general, we see that the main question is whether trends emerge in sequence or simultaneously. From the point of view of consumer states, technological innovation and the reduction of dependency on oil will be the main concerns. Taking a broader perspective, support for reforms and economic diversification in the oil-producing states will considerably reduce the risk of violent conflicts.

No comments:

Post a Comment